Content

- #1 Accounting Solution for Small Business Which You Need to Save Time and Confidently Run Your Business!

- Other Benefits

- QuickBooks Payroll Review 2023: Features, Pros & Cons

- QuickBooks Payroll Core vs Premium vs Elite Quiz

- Avail QuickBooks Payroll Customer Service

- Payroll Software & Services for Small Business

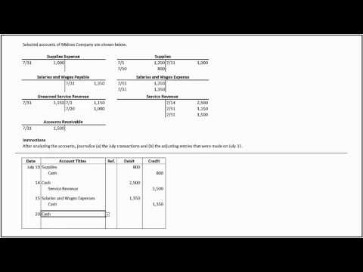

All the data is recorded and can be used for further analysis. This accounting software even enables the employer to maintain the attendance record for each and every employee. There are a variety of issues that can arise while using Payroll but no need to worry as our agents can walk you through any complications while using this accounting quickbooks payroll support tool. Understanding that every second counts and also every penny counts, we have made access to our support services much easier and swift. With our QuickBooks support team, you can not only enjoy the best solutions, but also endow you with the knowledge and tactics to deal with various other related errors in the future.

How do I contact QuickBooks support by phone?

If you still need help, you can call us at 800-446-8848. Was this helpful?

Payroll services for any QuickBooks versions starting in 2021 are still up and running. QuickBooks Desktop Enterprise includes QuickBooks Desktop Silver, Gold, Platinum, and Diamond plans. Compared to the base QuickBooks Desktop plans, QuickBooks Desktop Enterprise plans generally have more features and carry a much higher price tag. No problem; we’ve got you covered with our complete Intuit QuickBooks Online Payroll review. If you cancel your service, we will provide historical access to your data for 7 years.

#1 Accounting Solution for Small Business Which You Need to Save Time and Confidently Run Your Business!

If you are already using QuickBooks Online for accounting, QuickBooks Payroll is an excellent app for managing accounting as well as payroll from a common platform. However, QuickBooks Payroll is capable of taking care of your payroll needs as a stand-alone app as well. Our ratings take into account a product’s cost, features, ease of use, customer service and other category-specific attributes.

In case the user wants any kind of assistance, he/she can call our QuickBooks support team. Overall, users found the setup process generally easy and the interface user-friendly. Many also appreciate its automated payroll and tax solutions, including its seamless integration with QuickBooks. This is a step up from the other two plans because it doesn’t just cover mistakes the reps make but also the ones you make. QuickBooks Payroll Elite is ideal for small business owners who love QuickBooks and want dedicated help with HR issues.

Other Benefits

Learn how to set up e-file and e-pay in QuickBooks Desktop Payroll so you can pay and file … Quickbooks Online Payroll is just no substitute and the customer support is the worst. I pay for Quickbooks payroll with was separated from Quickbooks many …

How do I contact payroll support in QuickBooks?

If you still need help, you can call us at 800-446-8848.

All three plans give you access to how-to articles and videos, which you can access online or through the software. It’s easier to get the assistance you need through the software as the web-based help section covers all Intuit products, and the search bar doesn’t always narrow it down well. The articles themselves are easy to follow, though few have illustrations. The videos are on YouTube as well as inserted into the help sections where appropriate.

QuickBooks Payroll Review 2023: Features, Pros & Cons

It can also help you manage your payroll, HR, benefits and talent from a single platform. All QuickBooks Enterprise plan users pay an additional fee for contractors paid via direct deposit. QuickBooks Enterprise Diamond users will pay just $1/employee paid per month under the Assisted Payroll plan. Fastfix247 offers online services, such as bookkeeping, taxation, payroll management, and financial reporting. The enhanced payroll version of QuickBooks automatically completes the most recent state tax forms.

QuickBooks Payroll is a cloud-based, full-service payroll software that includes health benefits management and filing and paying of taxes. The Premium and Elite plans also offer timekeeping and some HR assistance. Naturally, all integrate easily with QuickBooks accounting plans, as well as other third-party applications. It provides full-service payroll software that lets you track projects and time.

They are additionally fit for responding to every one of your inquiries as they have the ability in the area of QuickBooks. Suppose your company has multiple state taxes, a more significant number of employees, and healthcare plans. Some people will argue that you can get support for QuickBooks payroll online by posting your queries on forums or by going through tutorials.

In this guide, we considered time tracking solutions for all those use cases. Most reviews are highlighting QuickBooks Payroll overall as a product and not the individual plans. It earned an average of 4.15 out of 5 stars for user reviews on third-party review sites. It’s a solid rating, but customer service is taking hits from reviewers because of the occasional long wait times and the customer reps’ poor responses.

However, business owners that don’t necessarily need same-day direct deposits and want a more affordable all-in-one platform might find other providers to be a better option. Check out our top-recommended payroll software for more options and information. QuickBooks Enterprise Gold, Platinum, and Diamond users are not required to pay the base subscription fee for QuickBooks Payroll, as Enterprise plans include payroll services.

- If you have not already migrated over to QuickBooks Online Payroll, Intuit has opened a transition period through May.

- QuickBooks Payroll from Intuit is a cloud-based payroll service that you can use stand-alone or in integration with QuickBooks Online.

- All you need to do is continue clicking at certain screens on the software.

- Assuming you are experiencing any specialized obstacles and errors while utilizing this product, then, at that point, don’t freeze.

The cost of these forms is already included in their Payroll subscription. I was on the phone with support for 1.5 hrs last week and they checked everything too … There are several factors that QuickBooks calculates payroll taxes …